12.03.2021

Private Equity International: ‘Great deal of interest’ in 401(k) market

PEI CFO magazine spoke to Robert Collins, Partner, Head New York Office, Partners Group about US defined contribution plans investing in private equity. Collins notes there has been a great deal of interest across the landscape since the Department of Labor issued guidance on 401(k) plan sponsors accessing the asset class in 2020, and that more competition in the market is anticipated as firms develop products to cater to these investors.

01.03.2021

Partners Group wins three PEI Media awards

Partners Group won three awards in PEI Media's 2020 awards process, including Renewables Investor of the Year Asia Pacific and Renewables Deal of the Year Asia Pacific from Infrastructure Investor, and Firm of the Year in Switzerland from Private Equity International. From the investment to acquire and construct the second stage of Murra Warra Wind Farm in Australia, on behalf of our clients, to launching a new bespoke private markets solution for UBS wealth management clients, the firm was recognized for various achievements made across its global platform during a challenging year.

01.03.2021

Mallowstreet: UK DC pension schemes and private markets

Mallowstreet, in partnership with Partners Group, surveyed over 50 UK Defined Contribution pension schemes, master trusts and investment consultants to understand their interests, needs and concerns when considering illiquid assets such as private markets. The findings suggest allocations to private markets could increase and that there is interest from UK pension schemes in a variety of private markets assets.

02.02.2021

Private Equity International: 'Why human capital is central to ESG'

Partners Group's Head of ESG & Sustainability, Carmela Mondino, spoke to Private Equity International about how the COVID-19 pandemic has further prioritized human capital as an ESG consideration for the firm when supporting its portfolio companies.

10.12.2020

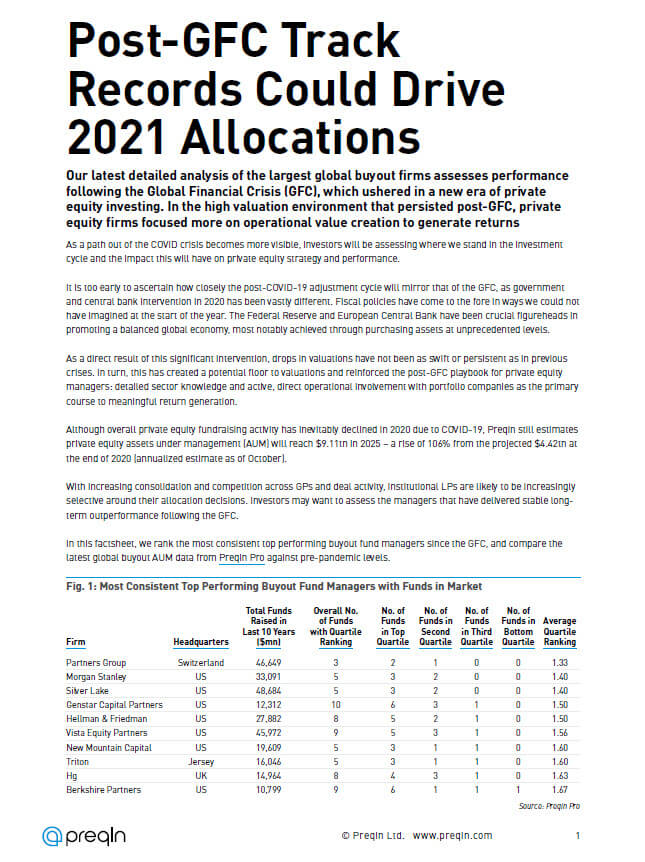

Preqin: Post-GFC Track Records Could Drive 2021 Allocations

In a recent Factsheet published by data provider Preqin, Partners Group was featured in a performance ranking of the largest diversified global buyout firms following the Global Financial Crisis (GFC). According to Preqin, the high valuation environment that persisted post-GFC ushered in a new era of private equity investing focused more on operational value creation to generate returns.

19.11.2020

SSF: How private equity is supporting the low carbon economy

In this report from Swiss Sustainable Finance, Partners Group looks at how private equity managers are ideally positioned to not only invest in businesses or projects that support the low carbon transition, but also better manage the environmental impact of their portfolio assets than public markets firms. This is because private equity managers typically have a stronger influence over how assets are managed, enabling them to implement sustainability initiatives more effectively. Partners Group also explains in the report how we assess the potential for assets to support the low carbon transition and how impact is measured longer term.